Stamp Duty & Registration Calculator India

Calculate property registration costs for all Indian states

Property Details

Registration Cost Breakdown

State Rules 2024

• Stamp Duty: 6% (Male), 5% (Female), 5.5% (Joint)

• Registration: 1% of property value

• Transfer Duty: 1% (Mumbai Municipal Corporation)

Your Complete Guide to India’s Stamp Duty & Registration Calculator India

Buying a property in India involves more than just the sale price. Two mandatory government charges—stamp duty and registration fees—can add a significant 4% to 10% to your total cost. These are not trivial expenses; on a ₹50 lakh property, this could mean an additional ₹2-5 lakhs.

This is where a Stamp Duty & Registration Calculator India becomes your essential financial planning tool. It provides instant, accurate estimates so you can budget with confidence and avoid last-minute financial surprises.

What Are Stamp Duty and Registration Charges?

· Stamp Duty is a state government tax levied on Stamp Duty & Registration Calculator India the legal document (like the Sale Deed) that transfers property ownership. It is calculated as a percentage of the property’s transaction value or its government-assessed “circle rate,” whichever is higher. Paying it is mandatory for the document to be legally valid.

· Registration Charges are a separate fee (typically around 1% of the property value) paid to the Sub-Registrar’s office to officially record the transaction in government records, finalizing your legal ownership.

How is Stamp Duty & Registration Calculator India Calculated?

The calculation is not uniform and depends heavily on your property’s location. Each Indian state sets its own rates and rules. The general formula used by calculators is:

Stamp Duty = (Property Value × State-specific Rate) + Surcharge + Cess

A good online calculator like Stamp Duty & Registration Calculator India simplifies this by asking for a few key details that influence the final cost:

· State and City: This is the most critical factor, as rates vary widely.

· Property Value: The sale agreement value.

· Buyer’s Profile: Gender and age, as many states offer concessions for female buyers and senior citizens.

· Property Type: Residential, commercial, or plot of land.

How to Pay Stamp Duty and Registration Fees

You have several convenient options to make these payments:

· E-Stamping: The most modern method. Pay online through your state’s portal or the SHCIL website and receive an electronic stamp certificate.

· Franking: An authorised bank or agent franks (stamps) your property document after you pay the duty.

· Physical Stamp Paper: You can purchase non-judicial stamp papers of the required value and execute the agreement on them.

Frequently Asked Questions (FAQs)

- Who pays the stamp duty and registration charges?

In most property sale transactions,the buyer is responsible for paying both stamp duty and registration charges. - Can I get a stamp duty refund?

Refunds are possible only under very specific conditions,such as a failed property transaction or if you qualify for an exemption you didn’t initially claim. You must apply formally with supporting documents to the authority. - Are there any tax benefits on these payments?

Yes.Under the old tax regime of the Income Tax Act, you can claim the amount paid for stamp duty and registration as a deduction under Section 80C, subject to the overall limit of ₹1.5 lakh per financial year. - Is stamp duty the same across all Indian states?

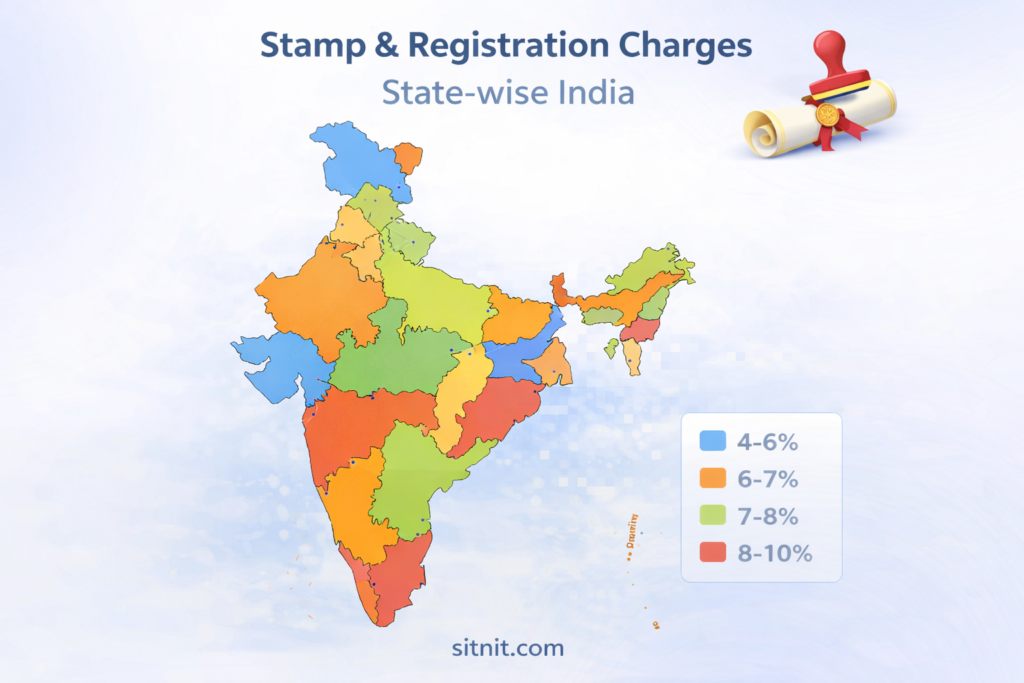

No.Stamp duty rates are determined by individual state governments, leading to significant variation. The table below shows how rates can differ.

Stamp Duty Rates in Key States (Indicative)

· Delhi: Male: 6%, Female: 4%, Joint (M+F): 5%

· Maharashtra: ~6% (5% + surcharge)

· Karnataka: ~5-5.6% (varies by location)

· Tamil Nadu: 7%

· Uttar Pradesh: 7% (with some concessions for females)

Note: Rates are indicative and subject to change. Always check the latest state regulations.

- Does a home loan cover stamp duty costs?

No.Banks do not finance stamp duty and registration charges. These are considered part of the “own contribution” and must be paid separately by the buyer from their own funds. - Why should I use an Sitnit Stamp Duty & Registration Calculator India online calculator?

An online calculator provides afast, accurate, and transparent estimate. It saves you from complex manual calculations, helps in precise budget planning, and ensures you are aware of all potential costs, including any concessions you may be eligible for.