EMI Calculator

Calculate monthly installments for Home, Car & Bike loans

Your Monthly EMI

EMI Calculator – Your Simple Way to Understand Monthly Loan Payments

An EMI calculator has become one of the most essential tools for anyone planning to take a loan, whether it’s for a home, a car, a bike, or any personal financial goal. Instead of guessing monthly instalments or worrying about hidden interest, an EMI calculator gives clarity in seconds. It helps you understand your exact payable amount every month so you can plan your budget comfortably and avoid surprises later. With just a few inputs like loan amount, interest rate, and tenure, this tool instantly provides a clear breakdown, making your financial decisions smarter and more confident.

Most people use an EMI calculator before applying for a loan because it saves time and reduces confusion. When you know your approximate EMI in advance, you can choose a suitable loan amount that fits your income without creating financial pressure. It also allows you to experiment with different numbers to understand how changing the interest rate or loan duration affects your monthly payment. This flexibility makes an EMI calculator a trusted companion for first-time borrowers as well as experienced home buyers.

Home Loan EMI Calculator

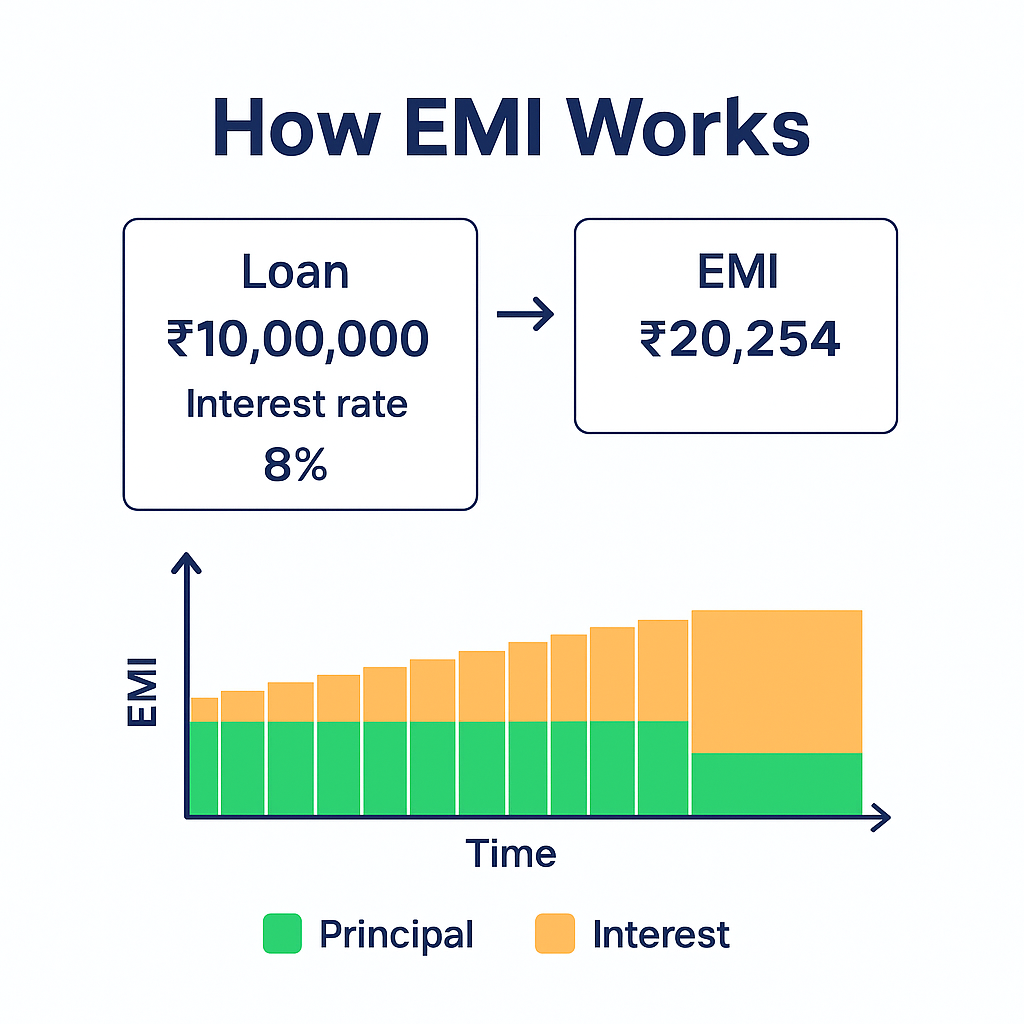

Among all types of loans, a home loan EMI calculator is used the most because home loans usually involve larger amounts and longer repayment periods. Even a small change in the interest rate or tenure can significantly impact the EMI. A home loan EMI calculator helps you choose a comfortable monthly instalment and plan long-term expenses more accurately. It also helps you estimate how much total interest you will pay over the entire loan period, giving you a complete financial picture before committing to such an important purchase.

Loan EMI Calculator

A general loan EMI calculator works the same way for personal loans, education loans, business loans, or any borrowing you plan to take. Personal loans often have higher interest rates compared to home loans, so knowing your EMI beforehand reduces the chances of selecting an amount that becomes difficult to repay later. By adjusting the loan amount or tenure, you can instantly see which EMI fits best into your lifestyle and savings plan. This simple tool encourages responsible borrowing and keeps your financial health stable.

Car Loan EMI Calculator

For everyday needs, many people rely on a car loan EMI calculator to plan their vehicle purchase. Cars come with different price ranges, down payment options, and interest structures. When you enter these details into an EMI calculator, you get a clear estimate of what you will pay every month. This helps you compare different loan offers from banks, choose a model within your affordability range, and avoid future repayment stress. The calculator acts like a practical guide that turns a big decision into a predictable, manageable plan.

Bike EMI Calculator

Similarly, a bike EMI calculator is extremely helpful for young buyers or anyone planning to purchase a two-wheeler. Since bike loans are smaller and often repaid quickly, knowing your EMI beforehand helps you choose the right tenure and interest rate. Whether it’s a commuter bike or a premium motorcycle, the EMI calculator makes the process transparent and easier to manage. It ensures that the excitement of purchasing your bike does not turn into financial pressure later.

The biggest advantage of using any EMI (Tool) calculator is the confidence it gives you. Instead of entering a loan blindly, you take every step with awareness. Your budget becomes more organized, your repayment plan becomes clearer, and your financial decisions become more secure. In today’s world, where loan options are endless and interest rates change frequently, having access to a fast and accurate EMI Tool calculator is more important than ever.

Whether you are planning to buy your dream home, upgrade to a new car, invest in a bike, or manage personal needs through a loan, an EMI Tool calculator makes the journey smoother. It empowers you with information, removes confusion, and helps you choose the right loan for your lifestyle. With a clear estimate of your monthly payments, you can move forward confidently, knowing your finances are under control and aligned with your long-term goals.