Who Is the Richest Person in the World — 2025 Edition

Who is the Richest Person in the World 2025?

Discover the top 10 wealthiest individuals globally based on 2025 projections and net worth estimates

World’s Richest Person 2025

Topping the global wealth rankings

Top 10 Richest People in the World 2025

💡 Heads up: These net worths are estimates — they fluctuate daily as stock markets and private asset valuations change.

🧑💼 Spotlight: Elon Musk — Reigning #1

Why does Elon Musk top the list in 2025? A combination of factors:

- His electric-vehicle company Tesla continues to lead in global EV adoption, pushing stock value upward.

- His rocket/space company SpaceX and AI firm xAI have seen major valuations climbs — SpaceX in particular is now a significant portion of his wealth.

- Musk’s diversification across industries — automotive, aerospace, AI — gives him a broad wealth base, less susceptible to one industry’s volatility.

Even with ups and downs (market dips, regulatory scrutiny, etc.), Musk’s multi-pronged investments keep him at the very top.

Other Top Names: From Luxury to Tech Giants

It’s not just tech that builds fortune. Let’s look at two key contrasting figures:

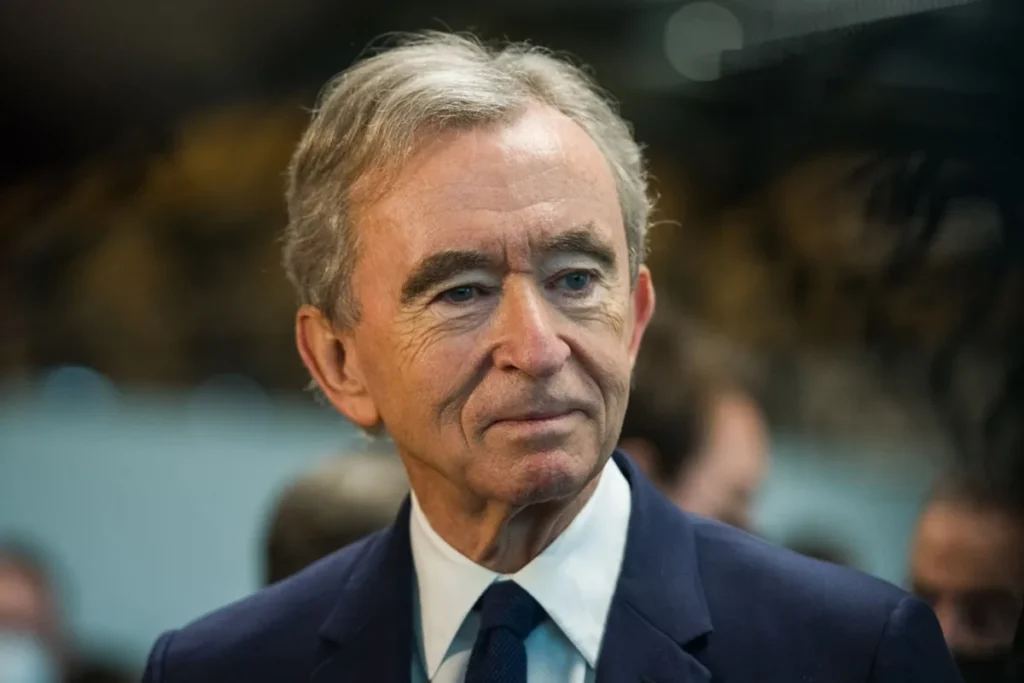

🏬 Bernard Arnault — Luxury Monopoly

Bernard Arnault and his family (via LVMH) control some of the biggest luxury and fashion houses in the world — from high-end fashion, jewelry, wines, to lifestyle brands. His net worth, at around $178 billion, places him among the world’s top tier of billionaires.

For Arnault, wealth comes from luxury goods and retail — a stark contrast to Musk’s tech- and innovation-driven empire.

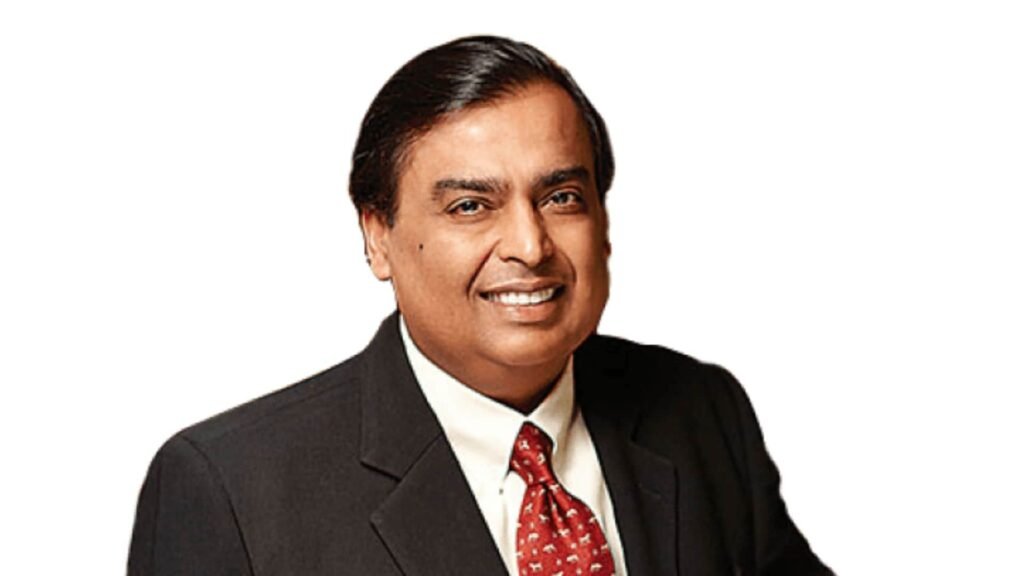

🇮🇳 Mukesh Ambani — Asia’s Billionaire Icon

What about Asia? India’s richest, Mukesh Ambani, remains a dominant figure. As of 2025, Ambani’s net worth is estimated around $116 billion, making him the wealthiest individual in India, even if he falls outside the global top 10 at the moment.

His wealth comes from diversified holdings — energy, telecom, retail, and investments. Ambani’s position highlights that while tech and luxury dominate global charts, diversified conglomerates still hold massive power in emerging markets.

📈 Why the Richest List Changes — Fast

Here’s why rankings shift frequently:

Stock market volatility: For people like Musk or Zuckerberg, a rise or fall in their company’s stock can swing their net worth by tens of billions.

- Valuation of private companies: For private companies (like SpaceX, or conglomerates), new funding or deals can change valuation dramatically.

- Global economy and currency exchange rates: Changes in global economic conditions, inflation, and currency fluctuations can affect net worth when converted to USD.

- Diverse wealth portfolios: Billionaires with multiple assets (real estate, investments, private companies, stocks) are less impacted by a single downturn — giving them stability.

That’s why someone can be #1 today and drop a few spots tomorrow — these lists are ever-changing.

🧠 Key Takeaways

- ✅ As of 2025, Elon Musk is widely recognized as the richest person in the world.

- ✅ The “Top 10” richest list isn’t dominated solely by one industry — it includes tech, luxury goods, retail, and investments.

- ✅ Bernard Arnault and Mukesh Ambani show that wealth doesn’t come only from technology — luxury, retail, and diversified industries still build global fortunes.

- ✅ The global billionaire list is dynamic — fortunes shift quickly with stock markets, global economy, and valuations.

🌍 Richest People by Continent & Region

Not only does global wealth cluster at the top, but it also spreads across continents. Here are some of the wealthiest known names by continent/region in 2025.

North America (USA) — Elon Musk remains the richest in North America.

Europe — Bernard Arnault (and family), head of the luxury-giant LVMH, is the richest in Europe.

Asia — Mukesh Ambani, chairman of Reliance Industries (and related ventures), is the richest person in Asia (and India) as of early 2025.

For other continents/regions (South America, Africa, etc.) — while they may not always be in the global top-10, various regional billionaires appear on the global list or in extended rankings.

Why Region-wise Division Matters

It reflects economic diversity: While tech and internet-age fortunes dominate globally (especially from USA), traditional industries — retail, manufacturing, energy — remain significant in regions like Asia or Europe.

It shows global distribution of wealth, not just concentration in one country.

Tesla Stock

Tesla Stock (TSLA) – Complete History From IPO to Today

Tesla stock, traded under the symbol TSLA on the NASDAQ, is one of the most discussed, volatile, and followed stocks in the world. From a small electric car startup to a trillion-dollar global company, Tesla’s stock journey has changed the investing world forever.

What is Tesla Inc.?

Tesla is an American electric vehicle and clean energy company founded in 2003. It designs and manufactures electric cars, battery energy storage systems, solar products, and is also deeply involved in artificial intelligence and autonomous driving technology.

Tesla Stock IPO – The Beginning

Tesla went public on June 29, 2010. The IPO (Initial Public Offering) price was $17 per share. At that time, Tesla was not yet profitable and was considered a highly risky investment.

Many early investors were unsure if electric cars would really become mainstream. But over time, as Tesla introduced cars like the Model S, Model 3, Model X, and Model Y, confidence in the company began to grow rapidly.

Major Tesla Stock Milestones

| Year | Event | Impact on Stock |

|---|---|---|

| 2010 | Tesla IPO at $17 per share | Company enters public market |

| 2013 | Model S gains popularity globally | Stock starts gaining strong attention |

| 2018 | Mass production of Model 3 | Huge increase in investor interest |

| 2020 | 5-for-1 Stock Split | Makes shares more affordable for investors |

| 2022 | 3-for-1 Stock Split | Further increases retail participation |

| 2023–2025 | Focus on AI, robotics, and energy systems | Stock shows high volatility and huge trading volume |

Tesla Stock Splits Explained

Tesla has performed two major stock splits in its history:

- 2020 – 5-for-1 Stock Split: Every 1 Tesla share became 5 shares.

- 2022 – 3-for-1 Stock Split: Every 1 Tesla share became 3 shares.

Stock splits do not change the actual value of the company. They only make individual shares cheaper, which attracts more retail investors.

Why Tesla Stock is So Popular

- Strong belief in electric vehicle future

- Led by Elon Musk, one of the most influential entrepreneurs in the world

- Heavy investment in AI and robotics

- Solar and energy storage business

- Strong brand value and loyal customer base

Risks of Investing in Tesla Stock

- Extreme price volatility

- High competition in the EV industry

- Market sensitivity to Elon Musk’s actions

- Regulatory and economic risks

- Dependence on innovation pace

Is Tesla Stock a Good Investment?

Tesla has made early investors extremely wealthy. However, it is still considered a high-risk, high-reward stock. Its future depends heavily on technological innovation, global EV demand, and economic conditions.

Some investors see Tesla as not just a car company, but a technology company that could redefine transportation, AI, and energy usage worldwide.

Future of Tesla Stock

The future of Tesla stock depends on:

- Advanced autonomous driving technology

- Robotaxi and AI services

- Expansion in emerging markets

- Battery and energy innovations

- Humanoid robotics (Optimus)

If Tesla succeeds in these areas, it could continue to dominate the market and remain one of the most powerful companies in the world.

Final Summary

Tesla stock has transformed from a risky bet into one of the most influential investments in modern history. From a $17 IPO to becoming one of the most valuable companies on Earth, TSLA represents innovation, disruption, and the future of technology.

Investing in Tesla is not just about buying a stock. It is a bet on the future of artificial intelligence, clean energy, and next-generation transportation.